Forging a sustainable path: Multifaceted efforts in renewable energy, carbon offsetting, and impact reporting

India’s energy needs are growing, and the country is committed to a sustainable future of energy with green hydrogen gaining attention as an option for meeting diverse energy requirements while reducing its carbon footprint. The National Green Hydrogen Mission, which aims at making India a global hub for green hydrogen production, use and export by 2030, has been initiated by the government of India. This ambitious initiative has significant implications for the country’s energy landscape, and it is crucial to understand the roles and strategies of various stakeholders in driving this transition. State governments take the lead: Developing regional green hydrogen hubs The emphasis on subnational roles and strategies is one of the major elements of the Green Hydrogen Mission. The development of regional Green Hydrogen Hubs is expected to have a significant role to play by state and local authorities. These hubs will serve as centers of excellence, fostering innovation, research, and development in the field of Green Hydrogen. By leveraging their unique strengths and resources, states can create a conducive ecosystem for the production, storage, and distribution of Green Hydrogen. Private sector initiatives: Driving the adoption of green hydrogen In the success of the Green Hydrogen Mission, the private sector also has a key role to play. Ways to integrate green hydrogen into their operations are being explored by companies in different sectors, such as power generation and mobility. A key factor in its uptake will be the availability of affordable and reliable green hydrogen. Investments in research and development, as well as the creation of a robust supply chain, will be essential to bring down the costs and ensure the scalability of Green Hydrogen projects. Advait Infratech is one of the companies that has shown a high level of profitability in the green energy sector. The company reported a 139.10% year-over-year increase in Profit After Tax (PAT) for the quarter ended March 2024. In addition to this, Advait also won the SECI Electrolyser Manufacturing Tranche I bid and was awarded 100 MW earlier this trade. The potential for growth in the energy sector, as well as opportunities available to businesses that are capable of adapting to green energy markets, is highlighted by the strong financial results. Addressing the challenges: A collaborative approach The challenges and obstacles which might emerge must be addressed in the course of India’s journey towards a green hydrogen future. The availability of skilled labour is one of the main challenges. In order to make sure that workers have the right knowledge and skills for working with this new technology, a substantial investment in education and training will be required as part of the Green Hydrogen Mission. In order to develop the necessary talent pool, collaboration between industry, academia and government will be crucial. A supportive policy framework: Key to success The need for a supportive policy and legal framework is also one of the challenges. However, a coherent national policy providing clarity on issues like pricing, taxation and incentives will be important for attracting investment and driving the adoption of green hydrogen, although many countries have put in place policies to encourage Green Hydrogen. The government should also consider introducing measures to incentivize the use of Green Hydrogen in various sectors, such as transportation and industrial processes. Conclusion: A sustainable future for India An important opportunity for India to move towards a sustainable energy future lies in the National Green Hydrogen Mission. India can build a thriving green hydrogen ecosystem that will drive innovation, generate jobs and reduce carbon emissions through the synergies of state governments, private industry and workers. But addressing the challenges and obstacles that may arise, as well as working on a collaborative and coordinated approach involving all interested parties is crucial to achieving this vision. India can become a global leader in the green hydrogen revolution with proper strategies and investments, setting an example for other countries to follow.

Ashish Kacholia Adds Stake in This Power Transmission Company

Advait Infratech Limited has announced strong financial performance for the quarter ended March 2024, with a 139.10% year-over-year increase in Profit After Tax (PAT) and secured funding of INR 82.3 crore. Investors in the stock market are always looking for ways to make informed decisions. One popular strategy is to track the activity of successful investors. These market gurus are believed to have a keen eye for spotting good opportunities. Retail investors, those who invest for their own personal accounts, can learn a lot by following the trades of ace investors. Public filings track changes in ace investors’ holdings. This reveals what stocks they are buying and selling, offering a glimpse into their investment strategies. For instance, a BSE filing on 30 May 2024, revealed that Ashish Kacholia, a well-known ace investor in India, has recently bought a large amount of shares in a power transmission company. But before we explore this specific activity, let’s get to know Ashish Kacholia better and understand why his investment choices are noteworthy. Who is Ashish Kacholia? When we talk about successful investors in India, it’s common to mention Ashish Kacholia. Kacholia is known for identifying the best multibagger stocks. He is known as the ‘Big Whale’ of the Indian stock market. Over the years, he has picked the best multibagger stocks by looking at the fastest-growing companies from the midcap and smallcap space. He started his career with Prime Securities in 1993. In 2003, he started Hungama Digital Entertainment Company along with Rakesh Jhunjhunwala. He is also the proprietor of Lucky Securities. — Advertisement —Investment in securities market are subject to market risks. Read all the related documents carefully before investing Ex-Swiss Investment Banker Reveals: The Kings of Cash Wealth Secret to Potentially Make 50-100% Gains in 1-2 Years More Details HereDetails of our SEBI Research Analyst registration are mentioned on our website – www.equitymaster.com————————————————— Which Stock Did Ashish Kacholia Buy and Why? The company in question is Advait Infratech. According to the BSE filling Ashish Kacholia bought 288,185 shares of Advait Infratech on 30 May 2024 at a price of Rs 1,388 per share. This represents 2.67% stake of the total equity. This is the first instance of Kacholia buying this stock. While we don’t know why he bought shares of Advait Infratech, there are some reasons that we can guess. #1 Good Financial Performance Between 2019-2023, the net sales and profits have registered at a 5-year compounded annual growth rate (CAGR) of 29.7% and 26.5%, respectively. The returns are also strong, with a 5-year average RoCE and RoE of 19.1% and 12.7%, respectively. Advait Infratech Financial Snapshot (2019-23) Year 2019 2020 2021 2022 2023 Revenue (Rs in m) 280 445 657 787 1,027 Profit after tax (Rs in m) 25 5 48 53 81 Gross profit margin (%) 14 11 8 13 16 Net profit margin (%) 9 1 7 7 8 Return on capital employed (%) 16 16 14 23 26 Return on equity (%) 13 3 15 14 18 Data Source: Ace Equity Even the company’s FY24 financial performance was quite good. The company reported a net profit of Rs 218.8 million (m) for FY24, a 159% increase compared to Rs 84.4 bn in FY23. Rising power demand across India created a favourable market for Advait Infratech’s transmission capacity. Advait Infratech’s revenues also saw a healthy increase of 99.9% to Rs 2,117.2 m in FY24, primarily driven by the surge in power demand. The EPS of the company increased to Rs 21.5 in FY24 from Rs 13.2 in FY23. Important: Did You Get Info on Top 2 Stocks to Ride India’s Bluechip Bull Run? #2 Foray into New Businesses Recognising the tremendous potential in the burgeoning green energy sector, Advait Infratech made a strategic foray in 2023 with the launch of Advait Greenergy. It is a subsidiary dedicated to making green energy solutions accessible and affordable across India through cutting-edge technology. By entering into the green energy sector, Advait Infratech demonstrated their ability to identify and capitalise on emerging opportunities. The sectoral tailwinds in the green energy sector boosted investor confidence for the power transmission company. Further solidifying their commitment to diversification, Advait Infratech ventured into the IT/IoT domain in January 2024. This new venture focuses on developing software and integrating solar pump devices/smart meters for real-time data monitoring and fault management. — Advertisement —Investment in securities market are subject to market risks. Read all the related documents carefully before investing Choose Your Pick Unnecessarily Risky Small Caps vs Small Caps Brimming with Opportunity Discover the Small Cap Strategy Thousands of Equitymaster Subscribers Use I’m InterestedDetails of our SEBI Research Analyst registration are mentioned on our website – www.equitymaster.com——————————————— How Advait Infratech Share Price has Performed Recently In the past five days and in the last month, Advait Infratech share price fell 4.9%. In 2024, so far it surged more than 143.9% and more than 381% in the last year. The stock touched its 52-week high of Rs 1,745 on 24 April 2024 and a 52-week low of Rs 273.3 on 19 June 2023. About Advait Infratech Advait Infratech is an India-based company, which is engaged in providing products and solutions for power transmission, substation, and telecommunication infrastructure. It operates with various verticals such as turnkey telecommunication projects, installation of the power transmission, substation and telecom products, marketing, and providing end-to-end solutions to the customers. The company manufactures and supplies capital stringing tools for the construction of the transmission line. It is involved in manufacturing optical fiber ground wire (OPGW), OFC cables, aluminum-clad steel wire, emergency restoration systems, and OPGW joint boxes. It provides live-line and off-line installations of the OPGW system. Its service range includes survey, erection, jointing, and commissioning until end-to-end line testing. The company also offers emergency restoration systems, porcelain and composite insulators, glass disc insulators, and earthing solutions stringing tools. To know more about the company, check out Advait Infratech’s fact sheet and quarterly results. You can also compare Advait Infratech with its peers. Advait Infratech vs KPT Industries Advait Infratech vs TRF Advait Infratech vs Disa India To know what’s moving the Indian stock

Ashish Kacholia bought 288,185 shares of this high-ROE, high-ROCE multibagger stock with Rs 1,728.3 crore order book; PAT zooms over 100%

Advait Infratech Limited has announced strong financial performance for the quarter ended March 2024, with a 139.10% year-over-year increase in Profit After Tax (PAT) and secured funding of INR 82.3 crore. On Friday, shares of Advait Infratech Ltd hit a 5 per cent upper circuit to Rs 1,452.75 per share from its previous closing of Rs 1,383.60. The stock’s 52-week high is Rs 1,745 and its 52-week low is Rs 273.25. The shares of the company saw a spurt in volume by more than 2.67 times on BSE. Advait Infratech Ltd is engaged in providing products and solutions for power transmission, power substation, and telecommunication infrastructure fields. Also, it operates with various verticals such as turnkey telecommunication projects, installation of power transmission, telecom products, etc. As of December 2023, the company has a Rs 172.83 crore order book. The Board of Directors of the Company, during a meeting held on Thursday, May 30, 2024, at their registered office, authorized a preferential issue of up to 5,92,940 equity shares. Each share will have a face value of Rs 10 but will be offered at a premium price of Rs 1,388, raising a total of Rs 82,30,00,720. The allotment will be divided among specific investors: Mr Ashish Kacholia will receive 2,88,185 shares for Rs 40,00,00,780; RBA Finance & Investment Co. will receive 2,88,185 shares for Rs 40,00,00,780; Mr Ashish Rathi will receive 14,409 shares for Rs 1,99,99,692 and Mr Abhijit Mukherjee will receive 2,161 shares for Rs 29,99,468. This issuance is subject to shareholder approval and adheres to the regulations outlined in Chapter V of the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018. Also Read: Vijay Kedia gains Rs 12,06,05,760 from this multibagger engineering stock in just 1 day as the company reports a 197 per cent jump in net profit Regarding the financials, Advait Infratech has a market cap of over Rs 1,400 crore with a 3-year stock price CAGR of 280 per cent. The company reported excellent numbers in its both Quarterly Results (Q4FY24) and annual results (FY24). The net sales increased by 46.2 per cent to Rs 59.73 crore and net profit increased by 106.2 per cent to Rs 7.23 crore in Q4FY24 over Q4FY23. The net sales increased by 100.4 per cent to Rs 208.85 crore and the net profit increased by 159.3 per cent to Rs 21.88 crore in FY24 over FY23. The shares of the company have an ROE of 38 per cent and an ROCE of 38 per cent. The stock gave multibagger returns of 375 per cent in just 1 year and a whopping 5,400 per cent in 3 years. Investors should keep a close eye on this Small-Cap stock. Disclaimer: The article is for informational purposes only and not investment advice.

Advait Infratech Limited Announces Strong Financial Performance And Secures Funding INR 82.3 Cr

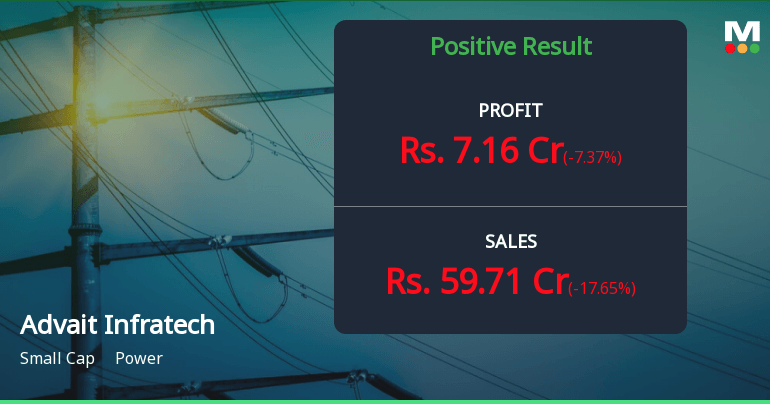

Advait Infratech Limited has announced strong financial performance for the quarter ended March 2024, with a 139.10% year-over-year increase in Profit After Tax (PAT) and secured funding of INR 82.3 crore. Ahmedabad: Advait Infratech Limited is delighted to share its robust financial results for the quarter ending March 31, 2024. The company has demonstrated exceptional growth in its key financial metrics, reflecting its strong operational efficiency and market position. FUNDRAISE: BoD has considered and approved the issuance of 5.9L shares at INR 1388/share, aggregating to INR 82.3 Cr. on a private placement basis, subscribed by Ashish Kacholia, RBA Finance & Investment and others. FINANCIAL PERFORMANCE: For the quarter, Advait Infratech reported standalone net sales of INR 59.71 crore, a remarkable increase of 31.93% compared to INR 40.64 crore in the same quarter last year. This significant rise in sales under the company’s ability to capture market opportunities and deliver value to its stakeholders. Whereas, there is phenomenal growth in Year-End Sales by 101%, reporting to INR 209.92 crore sales for FY 2023-24. Moreover, the quarterly net profit surged to INR 7.16 crore, marking an extraordinary growth of 90.82% from INR 3.74 crore in the corresponding period of the previous year. At the same time, PAT has increased from INR 10 Cr to INR 21.33 Cr for FY 23-24. This impressive increase in profitability highlights Advait Infratech’s effective cost management and strategic execution. The company’s EBITDA also saw a substantial rise. For the quarter, EBITDA reached INR 12.20 crore, up 82.52% from INR 6.68 crore in the previous year. This growth in EBITDA indicates a solid underlying business performance and a strong capability to generate cash flows. DIVIDEND DECLARATION: In addition to the strong financial performance, the Board of Directors has recommended a final dividend of INR 1.5 per share. This recommendation is subject to shareholder approval at the upcoming Annual General Meeting. The proposed dividend reflects the company’s commitment to rewarding its shareholders and sharing the benefits of its growth. Mr. Shalin Sheth, Founder and Managing Director of Advait Infratech Limited, commented, “Our exceptional financial performance this year highlights our strategic focus and operational efficiency. We remain committed to delivering sustainable growth and value to our shareholders.

Advait Infratech Limited announced that it expects to receive INR 823.00072 million in funding from RBA Finance and Investment Company and other investors

Advait Infratech Limited expects to receive INR 823 crore in funding to support its growth and expansion plans, enhancing its financial capabilities and strategic initiatives. Advait Infratech Limited announced a private placement of 592,940 equity shares of face value of INR 10 each at a price of INR 1,388 per share for gross proceeds INR 823,000,720 on May 30, 2024. The transaction includes participation from Ashish Rameshchandra Kacholia, Ashish Rathi, Abhijit Nripen Kumar Mukharjee and RBA Finance & Investment Co. The transaction is subject to approval of shareholders and was approved by board of directors.

Advait Infratech Limited announces strong financial performance and secures funding INR 82.3 Cr

Advait Infratech Limited has announced strong financial performance for the quarter ended March 2024, with a 139.10% year-over-year increase in Profit After Tax (PAT) and secured funding of INR 82.3 crore. Advait Infratech Limited is delighted to share its robust financial results for the quarter ending March 31, 2024. The company has demonstrated exceptional growth in its key financial metrics, reflecting its strong operational efficiency and market position. FUNDRAISE: BoD has considered and approved the issuance of 5.9L shares at INR 1388/share, aggregating to INR 82.3 Cr. on a private placement basis, subscribed by Ashish Kacholia, RBA Finance & Investment and others. FINANCIAL PERFORMANCE: For the quarter, Advait Infratech reported standalone net sales of INR 59.71 crore, a remarkable increase of 31.93% compared to INR 40.64 crore in the same quarter last year. This significant rise in sales under the company’s ability to capture market opportunities and deliver value to its stakeholders. Whereas, there is phenomenal growth in Year-End Sales by 101%, reporting to INR 209.92 crore sales for FY 2023-24. Moreover, the quarterly net profit surged to INR 7.16 crore, marking an extraordinary growth of 90.82% from INR 3.74 crore in the corresponding period of the previous year. At the same time, PAT has increased from INR 10 Cr to INR 21.33 Cr for FY 23-24. This impressive increase in profitability highlights Advait Infratech’s effective cost management and strategic execution. The company’s EBITDA also saw a substantial rise. For the quarter, EBITDA reached INR 12.20 crore, up 82.52% from INR 6.68 crore in the previous year. This growth in EBITDA indicates a solid underlying business performance and a strong capability to generate cash flows. DIVIDEND DECLARATION: In addition to the strong financial performance, the Board of Directors has recommended a final dividend of INR 1.5 per share. This recommendation is subject to shareholder approval at the upcoming Annual General Meeting. The proposed dividend reflects the company’s commitment to rewarding its shareholders and sharing the benefits of its growth. Mr. Shalin Sheth, Founder and Managing Director of Advait Infratech Limited, commented, “Our exceptional financial performance this year highlights our strategic focus and operational efficiency. We remain committed to delivering sustainable growth and value to our shareholders. About Advait Infratech Established in 2009, Advait Infratech delivers robust products and solutions for power transmission, substation, and telecommunication infrastructure. Operations cover turnkey telecommunication projects, power transmission and substation equipment installation, liasoning, marketing, and end-to-end solutions. Engaging in manufacturing and supplying essential power transmission products, including stringing tools, OPGW, OFC cables, ACS, ERS, and OPGW joint boxes, Advait expanded into Green Hydrogen Equipment Manufacturing Services & EPC in 2023. Additionally, the focus includes sustainability consultancy, decarbonisation consultancy, and carbon consultancy services, aiming to enhance the market landscape with cost-efficient, eco-friendly solutions.

Advait Infratech Reports Impressive Financial Results for Q1 2024, PAT Up by 139.10%

Advait Infratech, a smallcap power company, reported impressive Q1 2024 financial results with a 139.10% year-over-year increase in Profit After Tax (PAT) and positive trends in key areas like net sales growth, indicating strong financial performance Advait Infratech, a smallcap company in the power industry, has recently announced its financial results for the quarter ended March 2024. The company has shown a very positive performance in this quarter, with a score of 20 compared to 14 in the previous quarter. One of the key highlights of the financial results is the significant growth in Profit After Tax (PAT) for the half-yearly period, which has increased by 139.10% year on year. This trend is expected to continue in the near future, as the company has also shown a positive growth in Profit Before Tax (PBT) for the quarter, with a growth rate of 53.1% over the average PBT of the previous four quarters. Moreover, the company has already surpassed its PAT for the previous twelve months in just half a year, indicating a strong financial performance. The net sales for the quarter have also shown a positive growth of 25.8% over the average net sales of the previous four quarters. However, there are some areas that need improvement, as seen in the financial results. The interest cost for the half-yearly period has increased by 66.54%, indicating a rise in borrowings. Additionally, the non-operating income for the quarter is at its highest in the last five quarters, which may not be sustainable in the long run. Overall, Advait Infratech has shown a strong financial performance in the quarter ended March 2024, with positive trends in key areas. Investors are advised to hold their stocks, as recommended by MarketsMOJO.

Fueling the Future: How Indian States are Pioneering the Green Hydrogen Revolution

Indian states are leading the Green Hydrogen revolution by implementing supportive policies, attracting investments, and developing robust ecosystems to promote the production and usage of Green Hydrogen as a sustainable energy solution. As countries worldwide strive to mitigate climate change and achieve carbon neutrality, India is setting a bold precedent with its commitment to Green Hydrogen. This article explores how various Indian states are pioneering efforts in the Green Hydrogen revolution, highlighting key policies, advancements, and the potential impact of these initiatives on sustainable development. Understanding Green Hydrogen landscape in India India stands on the cusp of an energy revolution, with Green Hydrogen set to play a crucial role in its sustainable future. Green Hydrogen is created by splitting water into hydrogen and oxygen using renewable energy sources such as solar and wind, providing a clean, carbon-neutral substitute for traditional fossil fuels. With an estimated solar potential of about 750 GW and a wind potential of around 302 GW, India possesses abundant renewable resources that serve as a solid foundation for this burgeoning industry. The Thar Desert in Rajasthan, due to its extensive solar capacity, is an ideal site for large-scale solar projects integral to Green Hydrogen production. According to the International Renewable Energy Agency (IRENA), hydrogen could account for up to 12% of global energy consumption by 2050, potentially preventing six gigatonnes of CO2 emissions each year. This shift aligns with international climate objectives and positions India as a leader in the global green energy transition. Diverse Applications of Hydrogen: A Catalyst for Sustainable Solutions Hydrogen fuel cells find applications across multiple sectors, offering a versatile and environmentally friendly energy solution. Hydrogen-powered trains, buses, and select passenger vehicles are increasingly prevalent in transportation. Cities like Delhi are testing the use of hydrogen-powered buses to combat urban air pollution. In heavy industries such as steel and cement manufacturing, Green Hydrogen is seen as a cleaner alternative to fossil fuels. For the global steel industry, which contributes 7-9% of direct fossil fuel emissions, Green Hydrogen represents a significant opportunity to reduce environmental impacts. The fertilizer industry also presents a substantial market for Green Hydrogen, traditionally reliant on hydrogen in its production processes. Hydrogen’s flexibility extends to electricity generation, where it can be used in gas turbines or fuel cells. This adaptability offers utilities transformative potential to decarbonize their energy mixes. Additionally, blending hydrogen with natural gas is reducing carbon emissions from residential and commercial heating systems. This integration illustrates practical solutions to environmental concerns in daily energy usage, demonstrating hydrogen’s broad applicability in transportation, manufacturing, energy production, and heating systems, underpinning its role as a key driver of sustainable solutions. India’s Ambitious Leap into Green Hydrogen: Unveiling the National Green Hydrogen Mission Recognizing the significant potential of Green Hydrogen, the Government of India has launched the National Green Hydrogen Mission, allocating Rs 19,700 crore in the 2023 budget. This initiative reflects the government’s commitment to reducing carbon emissions and fossil fuel dependency. The government has set a carbon emission threshold of two kilograms of CO2 per kilogram of hydrogen to qualify as “Green” Hydrogen, fostering clarity and standardization in its production. With global hydrogen consumption currently around 70 million tons annually, predominantly as grey hydrogen from fossil fuels, India aims to produce 5 million metric tons of Green Hydrogen by 2030. This could save over INR 1 trillion in fossil fuel imports and cut 50 million metric tons of carbon emissions. A $2.3 billion government investment supports this ambition, aiming to enhance India’s renewable energy capacity by 125 gigawatts by 2030. Meanwhile, other global powers like China, the European Union, and the United States are also heavily investing in Green Hydrogen, with the global market projected to expand twentyfold to $80 billion by 2030. India’s strategy includes advancing efficient hydrogen production technologies, such as improved electrolysis, and supporting research in hydrogen storage and transportation. Furthermore, the government is fostering a supportive regulatory landscape, offering incentives and considering policy relaxations to attract investments and facilitate sector growth. Maharashtra’s Leadership in Green Hydrogen Development Maharashtra is emerging as a leader in the development of Green Hydrogen, underpinned by comprehensive policy support and substantial investments. The Maharashtra Green Hydrogen Policy 2023 sets ambitious goals to foster a robust ecosystem for Green Hydrogen and its derivatives such as green ammonia and methanol. This policy, valid until March 2030, aims to attract significant investment by offering incentives like up to 30% capital cost subsidy for specific projects and substantial concessions on transmission charges. The state has approved a budget of INR 8,562 crore for the implementation of this policy, focusing on renewable energy and Green Hydrogen projects. This includes funding for skilled manpower recruitment and training, emphasizing skill development to support this growing industry. Gujarat’s Strategic Investments in Hydrogen Ecosystem Gujarat is positioning itself to become a major hub in the global Green Hydrogen economy. The state has embarked on strategic investments to develop a robust hydrogen ecosystem, highlighted during the Vibrant Gujarat Global Summit 2024, where significant investments were announced. These investments aim to create a comprehensive infrastructure for Green Hydrogen production, including advancements in technology and capacity building for large-scale production. The ambition is to make Gujarat the world’s largest Green Hydrogen hub, with Prime Minister Narendra Modi noting that such initiatives will transform the global energy landscape, shifting towards more sustainable and renewable energy sources. This transformation is expected to bring substantial economic growth to Gujarat, attracting global investors and creating new job opportunities. Also, Advait Infratech is actively contributing to the green hydrogen revolution in Gujarat by setting up a significant facility for the manufacturing and assembly of fuel cells and electrolyzers in Kadi, Mehsana. This initiative, established through a MOU signed at the Vibrant Gujarat Global Summit 2024, represents a crucial step toward sustainable energy solutions in the region. Among other key initiatives, the state has planned sector-specific parks to lower capital and operational costs for industries, aiming to foster a conducive environment for the hydrogen economy. This strategic

Green Hydrogen in India: State-Level Initiatives Driving the Clean Energy Transition

India’s state-level initiatives are driving the clean energy transition by promoting Green Hydrogen production and usage, with several states implementing policies and incentives to support the development of Green Hydrogen hubs and infrastructure India is making bold strides in the fight against climate change with a strong commitment to Green Hydrogen, setting a global benchmark for carbon neutrality. Positioned at the forefront of an energy revolution, India sees Green Hydrogen as a key player in its sustainable agenda. Lets see how different states in India are leading the charge in the Green Hydrogen revolution, showcasing key policies, advancements, and their potential to drive sustainable growth. The Green Hydrogen Spectrum in India India’s Green Hydrogen spectrum is rapidly expanding, driven by ambitious national goals to become a global leader in clean energy production. This clean energy form is produced by splitting water into hydrogen and oxygen using renewable energy sources like solar and wind. With a vast potential of about 750 GW solar and 302 GW wind energy, India is well-equipped for major Green Hydrogen projects. According to the International Renewable Energy Agency (IRENA), hydrogen could comprise up to 12% of global energy use by 2050, reducing annual CO2 emissions by six gigatonnes, aligning with international climate goals and establishing India as a global leader in green energy transitions. Hydrogen’s Role Across Sectors: Enabling Sustainability Hydrogen fuel cells are being applied in various sectors, providing versatile, eco-friendly energy solutions. From powering trains and buses to being utilized in heavy industries like steel and cement, Green Hydrogen serves as a cleaner alternative to traditional fossil fuels. It is particularly promising for the steel industry, which is responsible for a significant portion of fossil fuel emissions. Additionally, Green Hydrogen is vital for fertilizer production, which heavily depends on hydrogen. Its adaptability also extends to electricity generation and residential heating, showcasing its potential in transforming energy use across multiple domains. India’s Bold Steps with the National Green Hydrogen Mission India’s commitment is further emphasized through the National Green Hydrogen Mission, with an allocation of Rs 19,700 crore in the 2023 budget. This mission aims to foster the production of Green Hydrogen with a stringent carbon emission limit to ensure environmental benefits. By targeting the production of 5 million metric tons of Green Hydrogen by 2030, India plans to reduce its fossil fuel dependence, save on imports, and cut significant carbon emissions. A $2.3 billion investment is directed towards enhancing renewable energy capacities, ensuring India remains competitive in the burgeoning global Green Hydrogen market. State Initiatives Leading Green Hydrogen Innovations Maharashtra: A Forerunner in Green Hydrogen Development Maharashtra is setting high standards with its comprehensive Green Hydrogen Policy 2023, which encourages investments and offers incentives for Green Hydrogen projects. The state’s robust policy framework aims to develop a thriving Green Hydrogen and derivatives market, contributing significantly to the industry’s growth and sustainability. Maharashtra provides substantial incentives for renewable projects, such as Green Hydrogen and electrolyzer manufacturing, including a 100% discount on electricity. Moreover, the first 20 Green Hydrogen refueling stations receive a 30% subsidy on capital costs, with each eligible for up to ₹4.50 crore. Gujarat: Pioneering the Global Green Hydrogen Economy Gujarat plans to become a prime hub for Green Hydrogen, driven by substantial investments and strategic initiatives. Announcements at the Vibrant Gujarat Global Summit 2024 highlighted significant steps towards creating an integrated Green Hydrogen infrastructure, aiming to position Gujarat as a global leader in sustainable energy sources. Rajasthan: Leveraging Solar Potential for Hydrogen Production Rajasthan is leveraging its abundant solar energy for Green Hydrogen production, aligning with national goals under the National Green Hydrogen Mission. The state’s initiatives are supported by robust financial plans and policies aimed at boosting renewable energy utilization and reducing Green Hydrogen production costs. Karnataka: Establishing India’s First Green Hydrogen Cluster Karnataka is making strategic investments to set up the country’s first Green Hydrogen cluster in Mangalore, focusing on using renewable sources for hydrogen production. This initiative represents a significant move towards integrating sustainable energy solutions into the state’s industrial and energy sectors. Challenges and Opportunities: The Path Ahead While India’s progress in Green Hydrogen is noteworthy, challenges like high production costs, infrastructure needs, and regulatory issues remain. However, the potential benefits of Green Hydrogen for energy security and economic growth are immense. Supportive policies at state and national levels are critical for advancing Green Hydrogen technologies and ensuring India’s prominent role in this global green revolution. Conclusion Indian states are driving the Green Hydrogen revolution, each making distinct contributions to this emerging sector. Maharashtra aims to become a production hub, Gujarat links renewable resources with infrastructure, Rajasthan focuses on exports, and Karnataka invests in research. Together, these efforts not only push India towards a sustainable future but also position it as a leader in Green Hydrogen technology, paving the way for eco-friendly innovation and robust economic growth.

Navigating the future of hydrogen

India’s energy demands are skyrocketing, and the country is committed to a sustainable energy future, with Green Hydrogen gaining attention as a viable option to meet diverse energy needs while reducing carbon footprint. A paradigm shift is occurring in the global energy landscape with the emergence of a burgeoning low-carbon hydrogen industry. This nascent industry is witnessing the birth of new companies, innovative business models, and a rapid scale-up from pilot plants to commercial operations. The creation of “hydrogen hubs” and “hydrogen valleys” signifies a regional collaborative effort, underscoring the importance of hydrogen in future energy strategies. Despite the enthusiasm, substantial challenges like cost reduction, transportation logistics, and defining support regimes remain. Notably, the commitment of governments worldwide to net-zero targets underscores the crucial role hydrogen is anticipated to play. This globally dispersed interest highlights the potential for hydrogen to bridge the gap between advanced and developing economies, offering a unified solution to a universal challenge. Hydrogen as a clean energy source Current advancements in hydrogen technology, particularly in electrolysis – the process of splitting water into hydrogen and oxygen using electricity – have significantly reduced the cost and increased the efficiency of hydrogen production. This progress is critical in making hydrogen a viable alternative to traditional fossil fuels. However, challenges remain in the widespread adoption of hydrogen as a primary energy source. The main hurdle is the current dependence on fossil fuels for hydrogen production, which involves significant carbon emissions. Transitioning to Green Hydrogen, produced using renewable energy, is essential but requires substantial investment in renewable energy infrastructure and technological innovation. Infrastructure and market development For hydrogen to be a mainstay in the energy landscape, developing a robust infrastructure is crucial. This involves the creation of efficient hydrogen production facilities, reliable storage systems, and extensive transportation networks. The development of such infrastructure is a significant undertaking that requires considerable investment and coordination among governments, industry players, and other stakeholders. Market development also plays a pivotal role in the hydrogen economy. Establishing a market for hydrogen, particularly in sectors hard to electrify like heavy industry and transportation, is essential for its growth. Policymakers and industry leaders need to work together to create favorable regulatory frameworks and incentives that encourage the use of hydrogen. Additionally, fostering public-private partnerships can accelerate the development and commercialization of hydrogen technologies. However, the cost associated with building this infrastructure and market remains a challenge. High initial investments and the current expensive nature of hydrogen production compared to traditional energy sources are barriers that need to be addressed through innovation, economies of scale, and policy support. Addressing sustainability in hydrogen production Environmental sustainability in hydrogen production is a critical aspect of its role in a low-carbon economy. While hydrogen is potentially a clean energy carrier, its production method greatly influences its environmental impact. Currently, the majority of hydrogen production is ‘grey hydrogen’, derived from natural gas, releasing significant amounts of carbon dioxide. Transitioning to ‘Green Hydrogen’, produced via renewable-powered electrolysis, is crucial to realize the environmental benefits of hydrogen. The development of carbon capture and storage (CCS) technologies offers a pathway to reduce emissions from grey hydrogen production. While this ‘blue hydrogen’ is a step in the right direction, it is not a completely carbon-neutral solution. Thus, the focus must be on accelerating the transition to Green Hydrogen production. Moreover, the environmental impact of the entire hydrogen production and supply chain, including water usage, must be considered. Ensuring that hydrogen contributes positively to environmental sustainability necessitates continuous research and development in efficient and eco-friendly production technologies. The global vision for hydrogen Presently, hydrogen predominantly serves as an industrial gas, manufactured primarily from fossil fuels through carbon-intensive processes. This sector, accounting for about 2% of global energy consumption, is poised for a dramatic transformation. The ambition is to reinvent hydrogen production into a cleaner, low-carbon process, potentially revolutionizing its role from a mere industrial byproduct to a versatile, low-carbon energy carrier. This vision aligns with global business interests and political ambitions, signaling a unified move towards adopting hydrogen and its derivatives as key players in the low-carbon energy narrative. The Middle East: Renowned for its vast oil reserves, the Middle East is uniquely positioned to become a global hydrogen powerhouse. The region’s abundant solar and wind resources are ideal for Green Hydrogen production through electrolysis. Countries like Saudi Arabia and the United Arab Emirates are investing heavily in hydrogen infrastructure, aiming to become major exporters of clean hydrogen. However, the challenge lies in developing cost-effective production and export mechanisms to turn this vision into reality. India: As one of the world’s fastest-growing economies, India’s energy demands are skyrocketing. The country’s commitment to a sustainable energy future is evident in its ambitious renewable energy targets. Hydrogen, particularly Green Hydrogen, is gaining attention as a viable option to meet India’s diverse energy needs while reducing its carbon footprint. The challenge for India lies in integrating hydrogen into its existing energy infrastructure and scaling up production affordably. Europe: In Europe, several countries are actively developing hydrogen infrastructures. The Netherlands plans a €1.5 billion hydrogen network by 2030, partially funded by the state. Germany’s National Hydrogen Strategy aims for an 11,200 km backbone by 2032, with significant roles for private and regional companies. Spain and the UK have conditional plans for hydrogen infrastructure development by 2026. Moreover, local gas grids might invest in connecting hydrogen producers to industrial users, though such projects are currently limited. A key challenge in Europe is the absence of short-term regulatory frameworks for renewable gas infrastructures, leading operators to seek private or state funding. Substantial investments in low-carbon hydrogen networks aren’t expected before 2030, but the sector must be financially prepared for potential heavy investments. Funding strategies and balance sheet strength are crucial for maintaining credit quality amid uncertain natural gas demand and unclear prospects for green gases. Regulatory support, affecting cost recovery and tariff changes, remains vital for the creditworthiness of these companies, with increased uncertainties as regulatory periods conclude and new gas usages emerge. To ensure